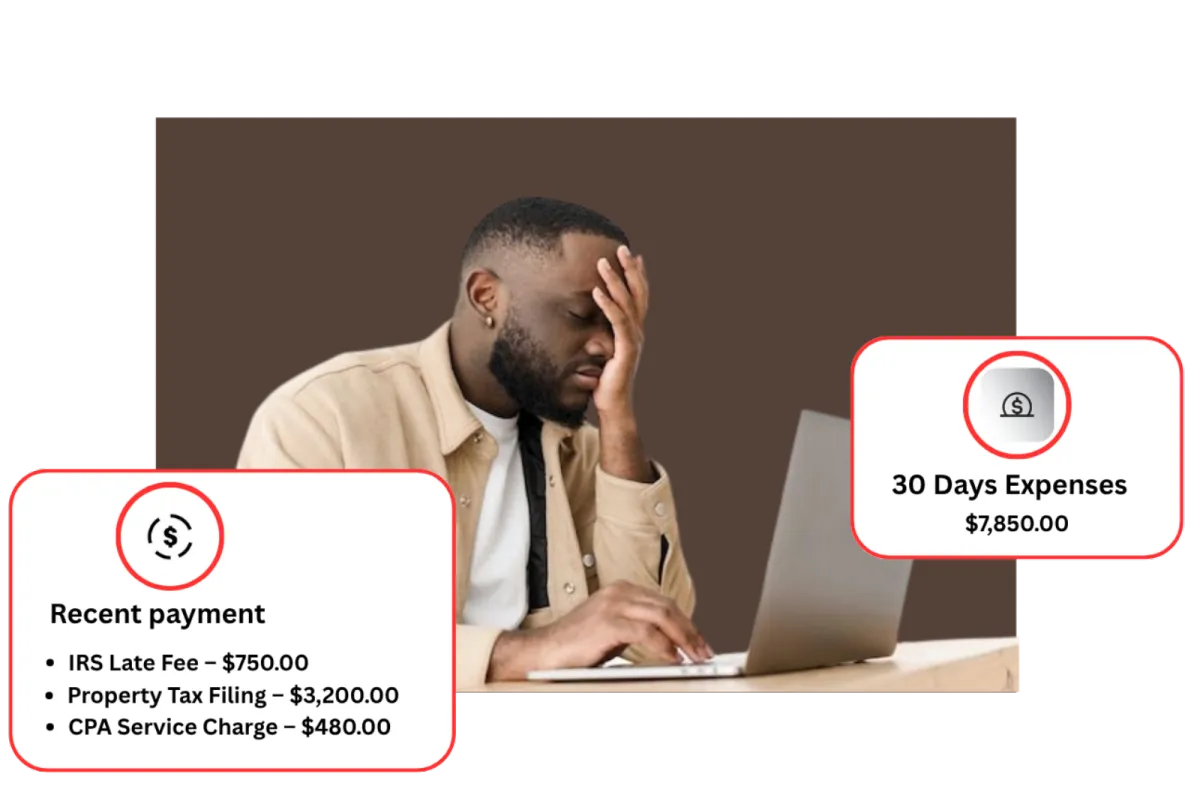

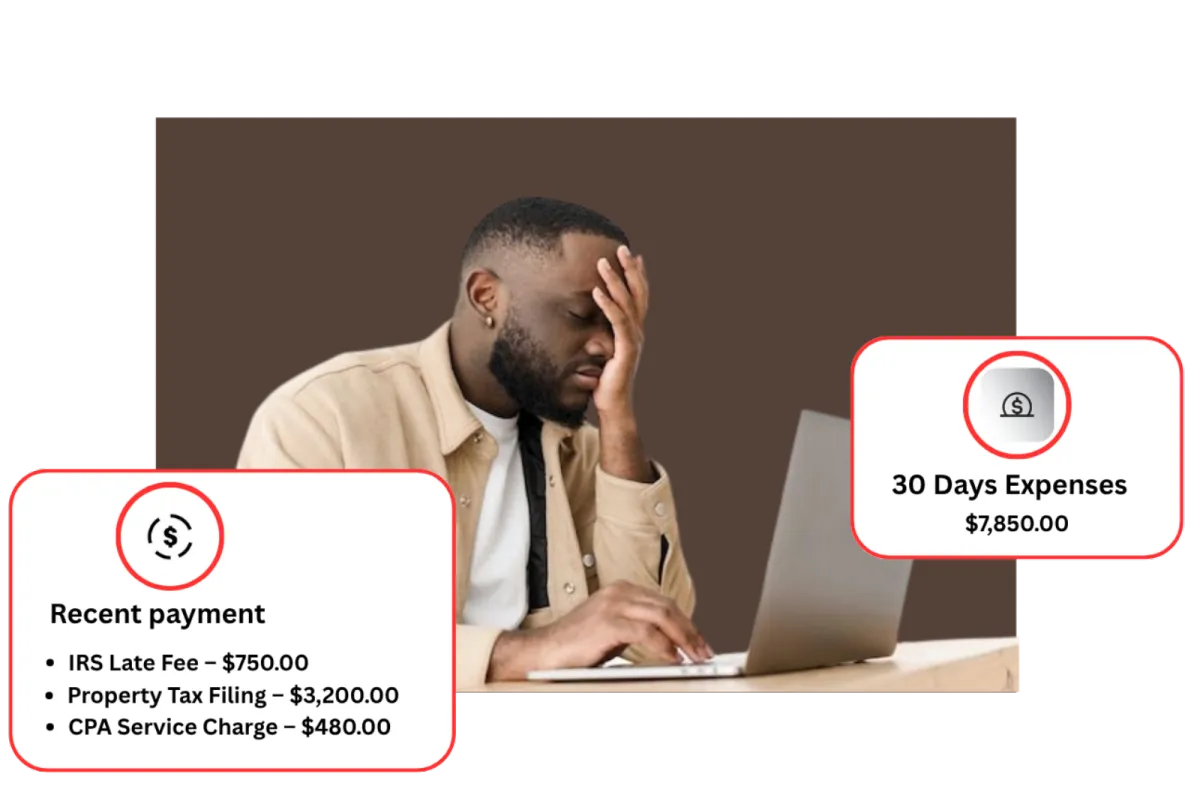

Stop Overpaying the IRS

If you’re a cleaner, landscaper, mobile CNA, handyman, or other home service pro, you could be leaving money on the table every tax season. Download the FREE Checklist:10 Tax Deductions Home Service Business Owners Forget to Claim.

Stop Overpaying the IRS

If you’re a cleaner, landscaper, mobile CNA, handyman,

or other home service pro, you could be leaving money

on the table every tax season. Download the FREE Checklist:10 Tax Deductions Home Service Business Owners Forget to Claim.

What You'll Get

Deductions

The top 10 write-offs your accountant probably never mentioned Save money by claiming deductions you didn’t know existed. These hidden expenses can reduce your taxable income.

Checklist

A simple checklist you can use before your next tax filing Get organized before tax season hits. Use this step-by-step guide to avoid mistakes.

Overpayment

How to avoid overpaying in self-employment taxes Many freelancers pay more than they should .Learn how to legally lower your tax bill.

Claim Your Free Download

Claim Your Free Download

TESTIMONIALS

What others are saying

"Loved everything so far"

This guide made things simple. It helped me talk to my accountant with confidence for the first time. I used to just nod along not knowing what was happening. Now I come prepared with the checklist, and I've saved money i didn't even know I was losing

"My life changed forever"

I used to dread tax season until I got this checklist. I discovered four deductions I wasn't even claiming -things like cleaning supplies and mileage I never tracked properly. I ended up saving over $900 this year, and now I feel way more in control of my business expenses.

"Highly recommend this"

The checklist showed me I was overpaying in taxes every year. I had no idea how much I could actually write off. It was easy to follow and helped me organize my paperwork before filing. Now I keep better records and worry less when tax time comes around

STILL NOT SURE?

Frequently Asked Questions

What services do you offer for businesses?

We provide a full range of tax services, including business tax preparation, tax planning, payroll tax management, IRS/state representation, and compliance support.

What documents do I need to prepare for business tax filing?

Typical documents include income statements, balance sheets, expense records, payroll reports, prior tax returns, bank statements, and details of fixed assets.

When are business taxes due?

Tax deadlines vary based on your business structure and location. For example, U.S. C corporations typically file by April 15 (or the 15th day of the 4th month after year-end), while partnerships and S corporations file by March 15.

Do I need to file taxes if my business didn’t make a profit?

Yes, most entities must still file an annual return, even if no income was earned or if the business operated at a loss.